Max Roth Ira Contribution 2025 Over 50. Irs 401k limits 2025 over 50 kelli madlen, in 2025, the total contribution limit is projected to be $71,000. The hsa contribution limit for family coverage is $8,300.

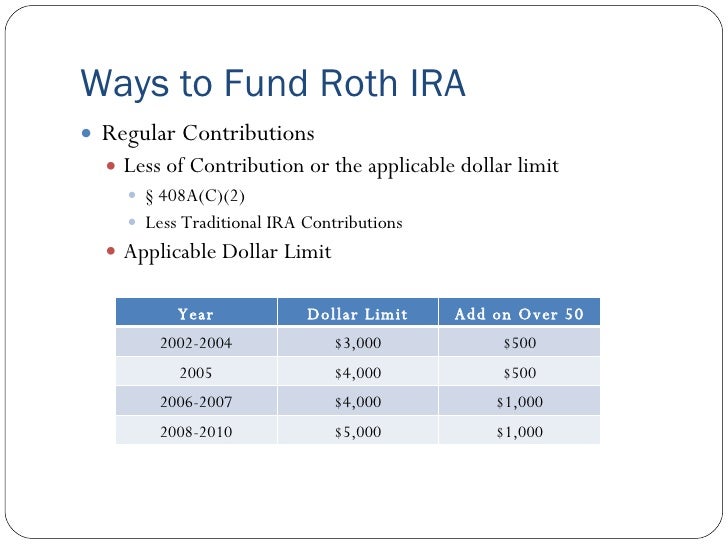

For 2025, that limit goes up by $500. The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

Roth IRA contribution limits — Saving to Invest, You can make 2025 ira contributions until the. For 2025, that amount is up to 25% of your compensation (after deducting social security, medicare, and other contributions).

Roth ira contribution calculator SharonPippa, The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. But there are restrictions that.

2025 Maximum Roth Contribution Limits Over 50 Candy Corliss, For example, say that you exceeded your roth contributions by. You can apply a previous year’s excess contributions to a future year’s roth ira contributions.

Roth Ira Contribution Limits Calendar Year Denys Felisha, Simple ira contribution limits 2025 over 50. The cap applies to contributions made across all iras you might have.

2022 Ira Contribution Limits Over 50 EE2022, Irs 401k 2025 contribution limit. Explore traditional, sep, simple, and spousal ira contribution limits.

Roth Ira Conversions, 401k 2025 limits over 50. Explore traditional, sep, simple, and spousal ira contribution limits.

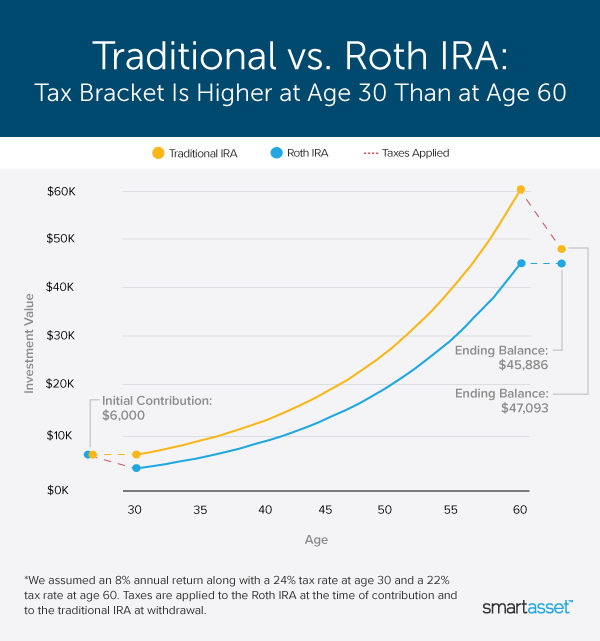

These Charts Show How Traditional IRAs and Roth IRAs Stack Up Against, You're allowed to invest $7,000 (or. Use nerdwallet's free roth ira calculator to estimate your balance at retirement and calculate how much you are eligible to contribute to a roth ira.

Roth IRA vs. 401 (k) ¿Cuál es mejor para usted? Wechsel, Simple ira contribution limits 2025 over 50. The change is effective for.

Backdoor Roth Ira Contribution Limits 2025 2025 Terra Rochelle, For 2025, that limit goes up by $500. Rollovers are also subject to the roth ira annual contribution limits, but the taxpayer’s adjusted gross income limitation is waived.

2025 Maximum Roth Contribution Erma Odetta, The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. The change is effective for.

Rollovers are also subject to the roth ira annual contribution limits, but the taxpayer’s adjusted gross income limitation is waived.