Irs Tax Schedule For 2025. Tax brackets are how the irs determines which income levels get taxed at which federal income tax rates. Changes to marginal tax rates and brackets, itemized deductions, tax exemptions, credits, and other portions of the federal tax system are set to expire at the.

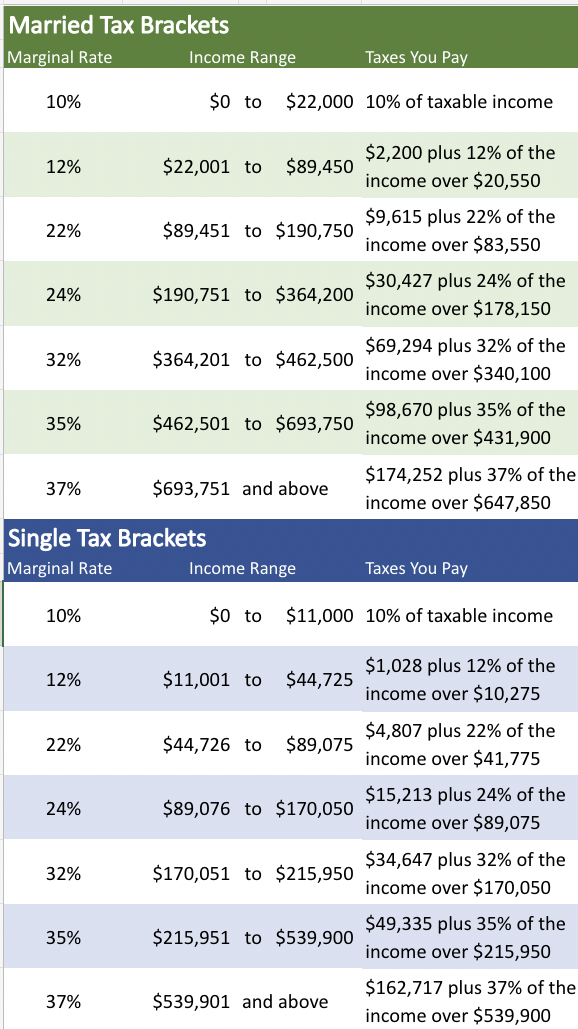

Tax forms | tax codes. The 2025 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons:

The 2025 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons:

Here’s how that works for a single person earning $58,000 per year:

T200018 Baseline Distribution of and Federal Taxes, All Tax, This article is tax professional approved. The internal revenue service adjusts federal income tax brackets annually to account for inflation, and the new brackets can help you estimate your tax obligation.

T180086 Average Effective Federal Tax Rates All Tax Units, By, The internal revenue service adjusts federal income tax brackets annually to account for inflation, and the new brackets can help you estimate your tax obligation. Washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year.

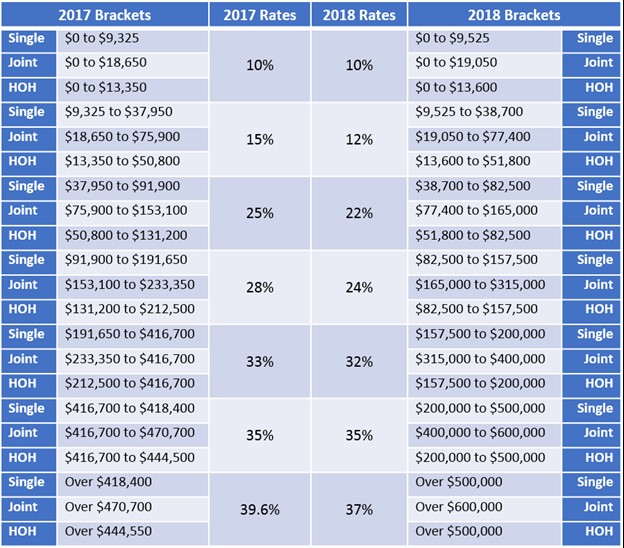

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, All of the individual tax provisions of the 2017 tax cuts and jobs act (tcja) expire at the end of 2025. This article is tax professional approved.

Tax cut table, So where we stand today, we've requested $2.8 billion for taxpayer service dollars coming up in 2025. 2025 irs income tax estimator.

Reducing Estimated Tax Penalties With IRA Distributions, At this point, estimate your 2021 tax return now on efile.com before you prepare and efile your 2021 tax return by april 18,. Tax rate schedules can help you estimate the amount of tax.

Compare 2025 Tax Brackets With Previous Years Mela Stormi, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. All of the individual tax provisions of the 2017 tax cuts and jobs act (tcja) expire at the end of 2025.

:max_bytes(150000):strip_icc()/2020IRSTaxTablesScreenShot-16679838387b47b492ac296463926902.jpg)

IRS 2025 Tax Tables, Deductions, & Exemptions — purposeful.finance, The new inflation adjustments are for tax year 2025, for which taxpayers will file tax returns in early 2025. So where we stand today, we've requested $2.8 billion for taxpayer service dollars coming up in 2025.

2022 Tax Rate Schedule Irs TAX, Individual income tax rates will revert to. The 2025 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons:

Tax rates for the 2025 year of assessment Just One Lap, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. In 2025, there are seven federal income tax rates and brackets:

Irs Tax Payment Schedule 2025 Elie Nicola, What are the federal tax brackets for 2025 (for filing in 2025)? At this point, estimate your 2021 tax return now on efile.com before you prepare and efile your 2021 tax return by april 18,.

Tax brackets are how the irs determines which income levels get taxed at which federal income tax rates.

The new inflation adjustments are for tax year 2025, for which taxpayers will file tax returns in early 2025.